nd sales tax rate 2021

The North Dakota income tax has five tax brackets with a maximum marginal income tax of 290 as of 2022. Local Taxing Jurisdiction Boundary Changes 2021.

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

North Dakota has state sales tax of 5 and allows local governments to collect a local option sales tax of up to 3.

. Exact tax amount may vary for different items. Simplify North Dakota sales tax compliance. The North Dakota Department of Revenue is responsible for.

The Fargo sales tax rate is. Detailed North Dakota state income tax rates and brackets are available on this page. The Northwood sales tax rate is.

You may also view the local sales tax rate change notifications at. Average Sales Tax With Local. Lowest sales tax 45 Highest sales tax 85 North Dakota Sales Tax.

Gross receipts tax is applied to sales of. 2020 rates included for use while preparing your income tax deduction. Groceries are exempt from the North Dakota sales tax.

Thursday July 01 2021. The minimum combined 2022 sales tax rate for Northwood North Dakota is. What is the sales tax rate in Portland North Dakota.

Explore 2021 sales tax by state. Raised from 7 to 8. In North Dakota theres a tax rate of 11 on the first 0 to 40125 of income for single or married filing taxes separately.

New mobile homes at 3. The County sales tax rate is. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales.

Taxpayers are residents of North Dakota and are married filing jointly. ND Rates Calculator Table. North Dakota sales tax is comprised of 2 parts.

Free sales tax calculator tool to estimate total amounts. 2020 rates included for use while preparing your income tax deduction. Thats why we came up with this.

Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 0959 for a total of 5959 when combined with the state sales tax. The North Dakota sales tax rate is currently. The County sales tax rate is.

The latest sales tax rate for Blanchard ND. An additional tax may be imposed on the rental of lodging and sales of prepared food and beverages. Lodging Restaurant Tax.

Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85. If youre married filing taxes jointly theres a tax rate of 11 from 0 to 67050. The Portland sales tax rate is 2.

Local Tax Changes 1-01-2022 Created Date. Find 49900 - 49950 in the. Local Lodging Tax - May not exceed 2.

2021 state and local sales tax rates. This is the total of state county and city sales tax rates. North Dakota has a statewide sales tax rate of 5 which has been in place since 1935.

Some ZIP Codes overlap a taxing jurisdiction so entering only the 5-digit code may result in an incorrect result. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. The North Dakota sales tax rate is 5 as of 2022 with some cities and counties adding a local sales tax on top of the ND state sales tax.

10132021 103842 AM. Compare 2021 sales tax rates by state with new resource. Did South Dakota v.

The North Dakota State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 North Dakota State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Look up 2021 North Dakota sales tax rates in an easy to navigate table listed by county and city. The minimum combined 2022 sales tax rate for Fargo North Dakota is.

Counties and cities can charge an additional local sales tax of up to 3 for a maximum possible. Schedule ND-1NR line 22 to calculate their tax. This rate includes any state county city and local sales taxes.

City of Bismarck. This rate includes any state county city and local sales taxes. Please use due diligence to obtain the 9-digit zip code.

Did South Dakota v. Local Taxes City or County Taxes Cities and counties may. What is the sales tax rate in Northwood North Dakota.

Thursday July 01 2021. The North Dakota sales tax rate is currently. Raised from 7 to 75.

There are a total of 213 local tax jurisdictions across the. The latest sales tax rate for Sarles ND. South Dakota and Utah did so only in comparison to those that enacted more substantial local rate increases.

374 rows 2022 List of North Dakota Local Sales Tax Rates. Pursuant to Ordinance 6417 as adopted June 23 2020 the boundaries of the City of Bismarck will change for sales and use. Find your North Dakota combined state and local tax rate.

Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85. If a special tax applies to the sale add the special tax rate to the tax rate identified by the rate locator to determine the total tax rate to apply to the sale. The County sales tax rate is 0.

The governing body of any city or county may by ordinance impose a city or county tax. Arkansas went from 2 nd to 3 rd highest on its own meritalthough the actual change in its local. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales.

Many cities and counties impose taxes on lodging and prepared foods and beverages. For those earning more than. New farm machinery used exclusively for agriculture production at 3.

The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. Did South Dakota v. To receive the sales tax rate change notifications make sure you are subscribed to the ND Sales and Special Taxes list.

This is the total of state county and city sales tax rates. Their North Dakota taxable income is 49935. If your ND taxable.

City of Bismarck North Dakota. With local taxes the. 2022 North Dakota state sales tax.

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Portland North Dakota is 7. 31 rows The state sales tax rate in North Dakota is 5000.

The North Dakota sales tax rate is currently 5. ND Rates Calculator Table. North Dakota sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Pursuant to Ordinance 6369 as adopted May 12 2020 the boundaries of the City of Bismarck will change for sales and use tax purposes effective January 1 2021.

Careers At The North Dakota Office Of State Tax Commissioner

Amazon Avoids More Than 5 Billion In Corporate Income Taxes Reports 6 Percent Tax Rate On 35 Billion Of Us Income Itep

Paddle Help Center Which Countries Does Paddle Charge Sales Tax Or Vat For

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

Comparative State And Local Taxes Washington Department Of Revenue

The Most And Least Tax Friendly Us States

Vape E Cig Tax By State For 2022 Current Rates In Your State

State Income Tax Rates Highest Lowest 2021 Changes

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

States With Highest And Lowest Sales Tax Rates

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

North Dakota Sales Tax Rates By City County 2022

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

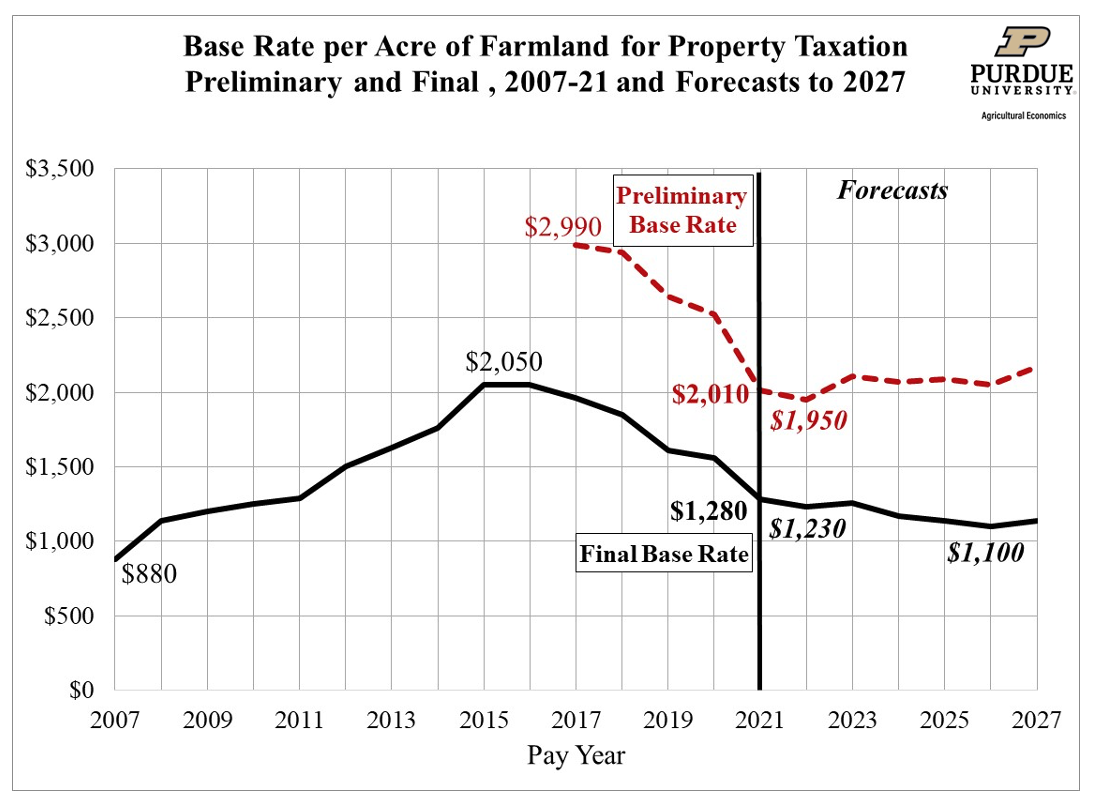

Farmland Assessments Tax Bills Purdue Agricultural Economics

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation