mortgage loan officer jobs no experience

The maximum debt to income ratio is capped at 43. Mortgage Loan Originators typically make 05 to 1 of the buyers loan amount.

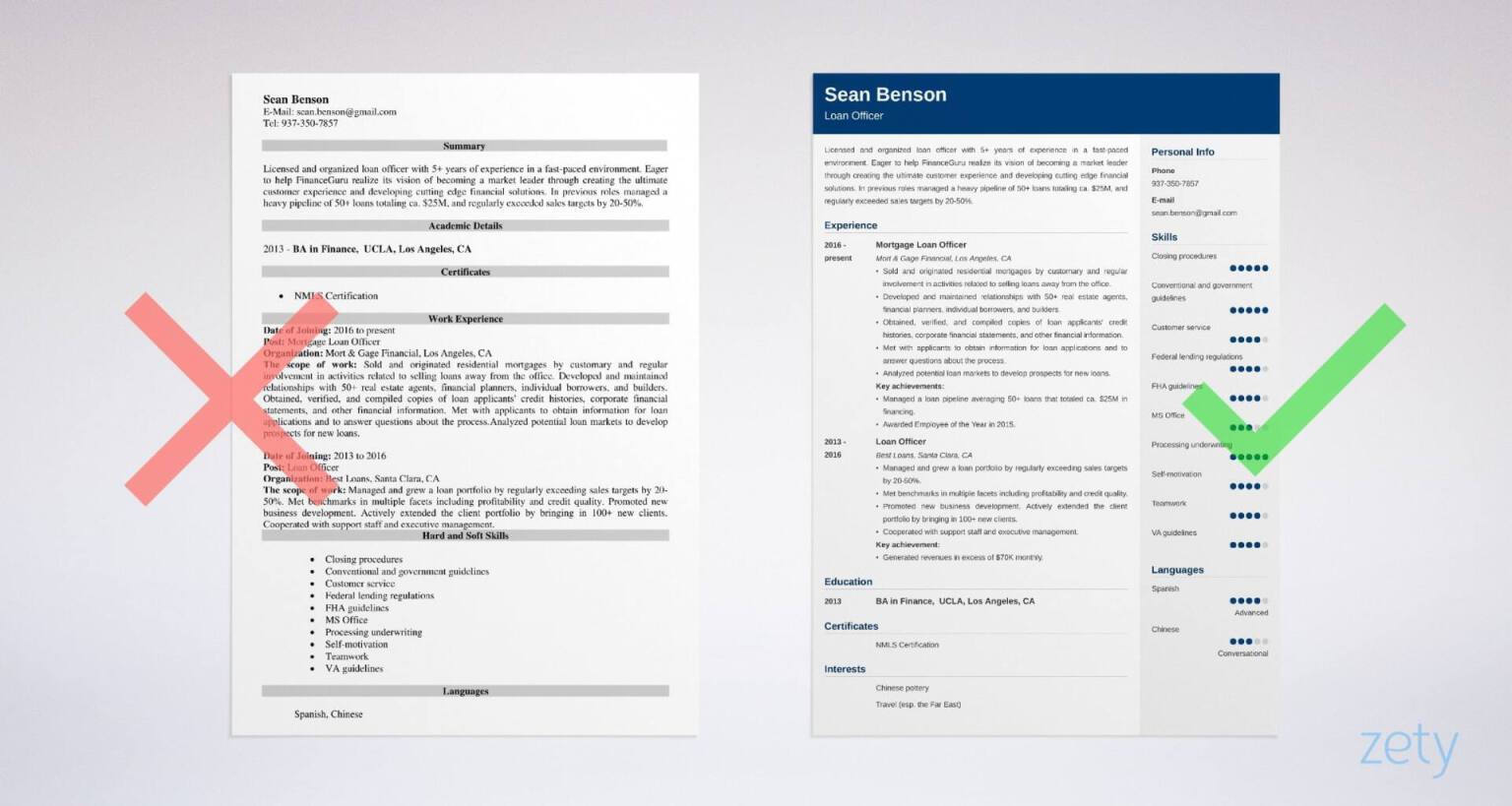

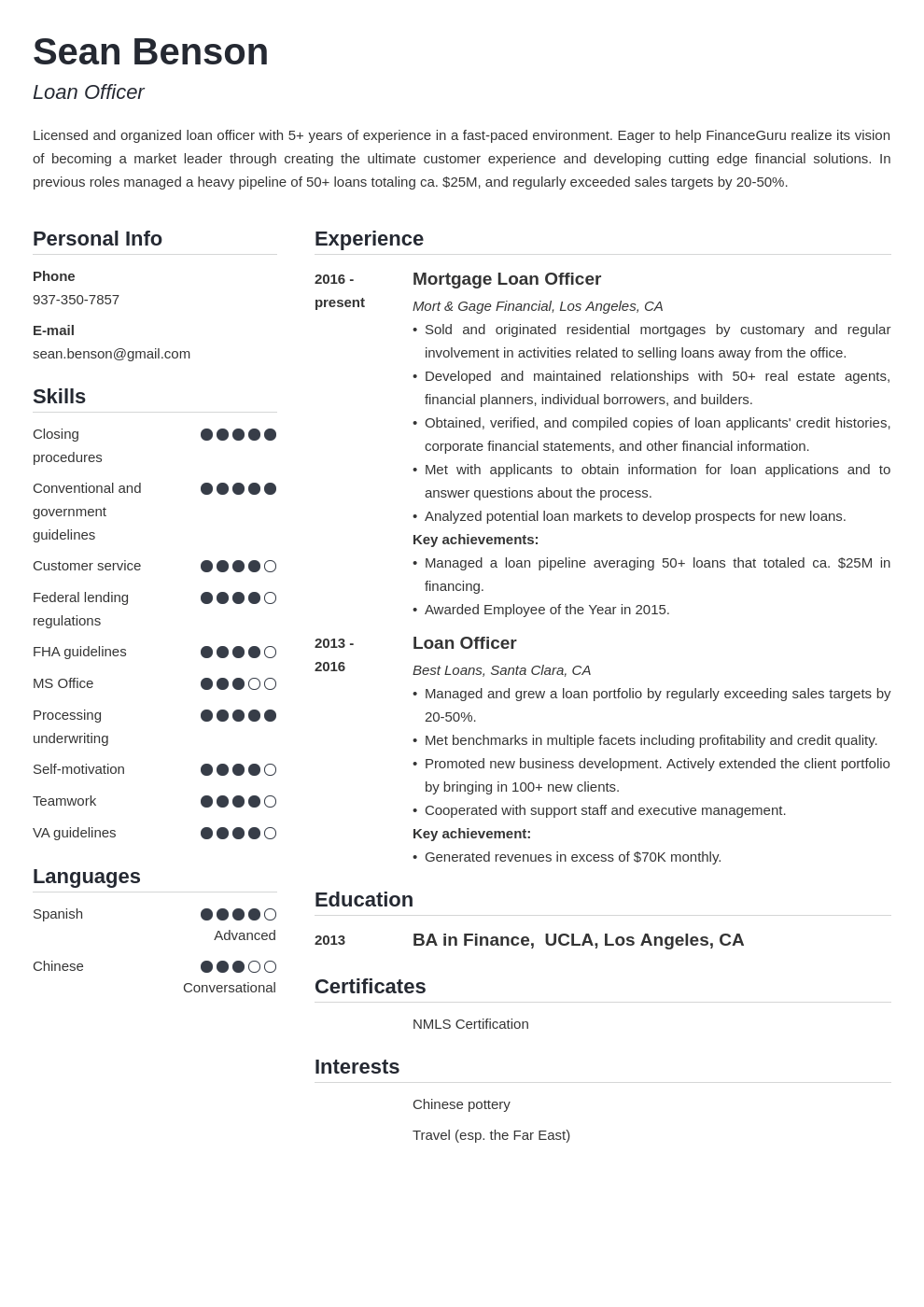

Loan Officer Resume Sample With Job Description Skills

Borrowers who put less than 20 down on an FHA mortgage will pay a mortgage insurance premium or MIP which is usually around 1 of the loan.

. The MIP can be paid upfront or over the life of the loan. Mortgage points represent a percentage of an underlying loan amount one point equals 1 of the loan amount. For example a 300000 mortgage loan will yield 1500 to 3000 in commission.

The expatriate mortgage loan program is 30-year adjustable-rate mortgages. A one-year reserve of principal interest taxes and insurance is required besides the 20 down payment. Your annual income depends on the area you work.

The expatriate mortgage loan borrower needs to show that he or she has assets and compensating factors. Mortgage points are an additional upfront cost when you close on your loan but they. Before the housing crash of 2008 the origination fees were as high as 4 to 5 of the loan amount.

This is the origination fee.

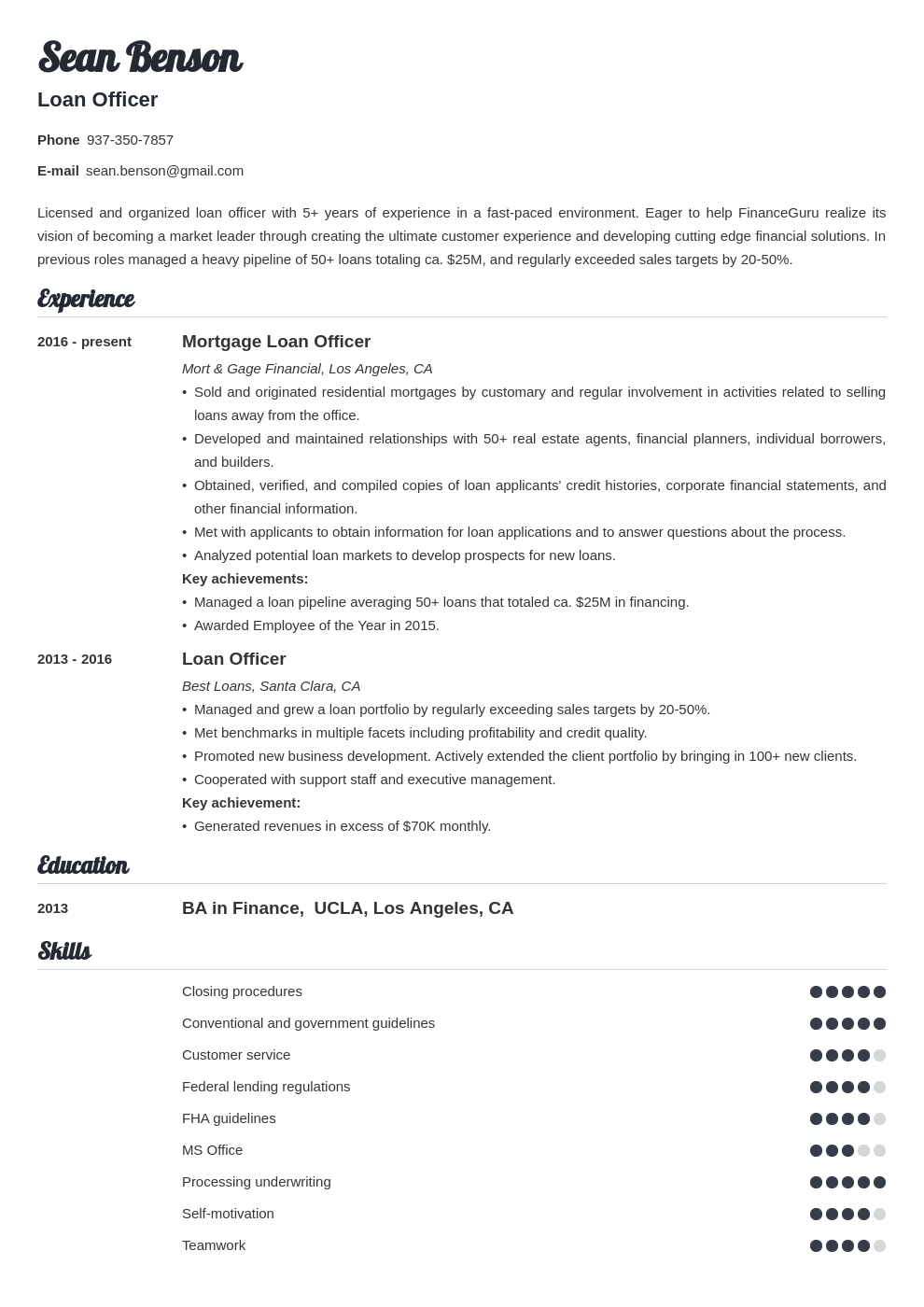

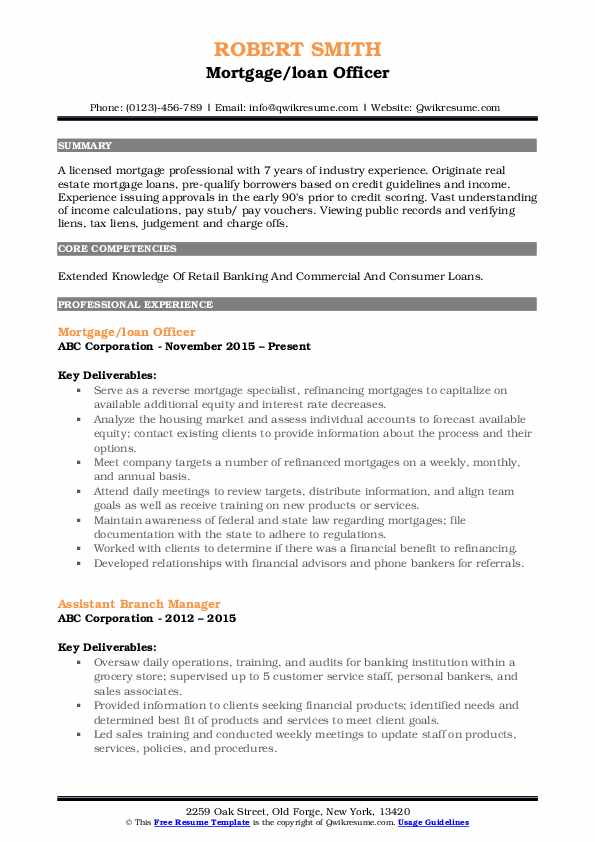

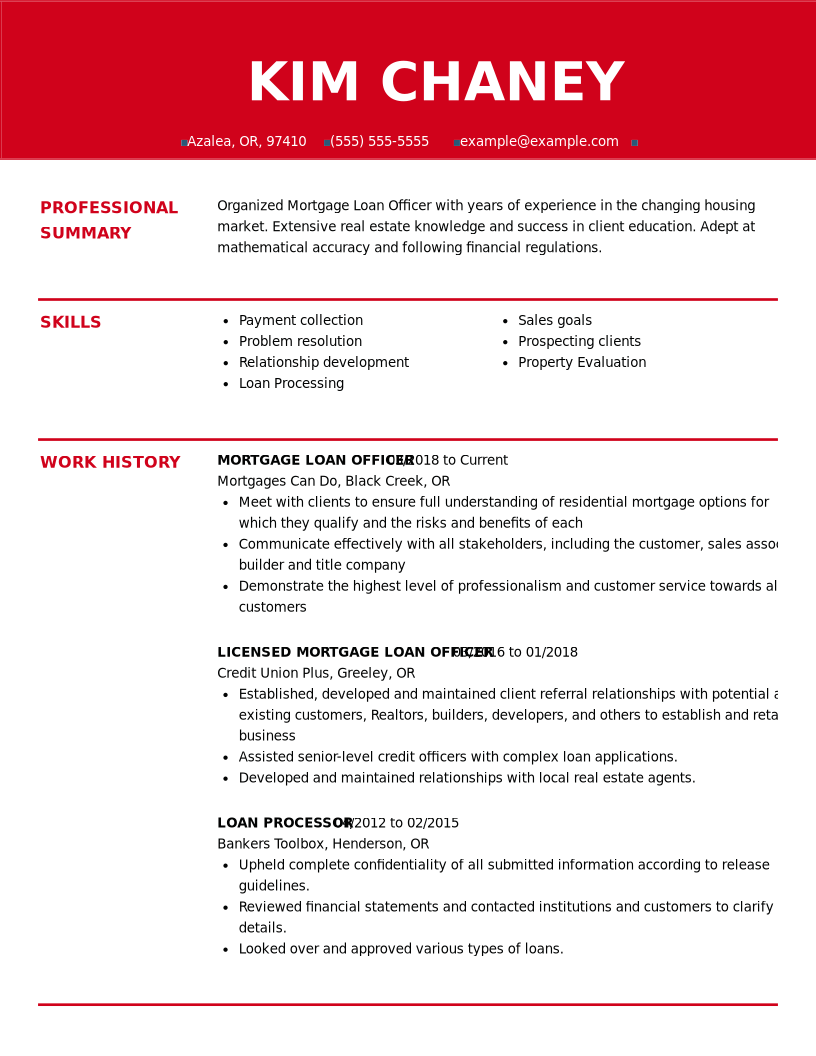

Loan Officer Resume Example Myperfectresume

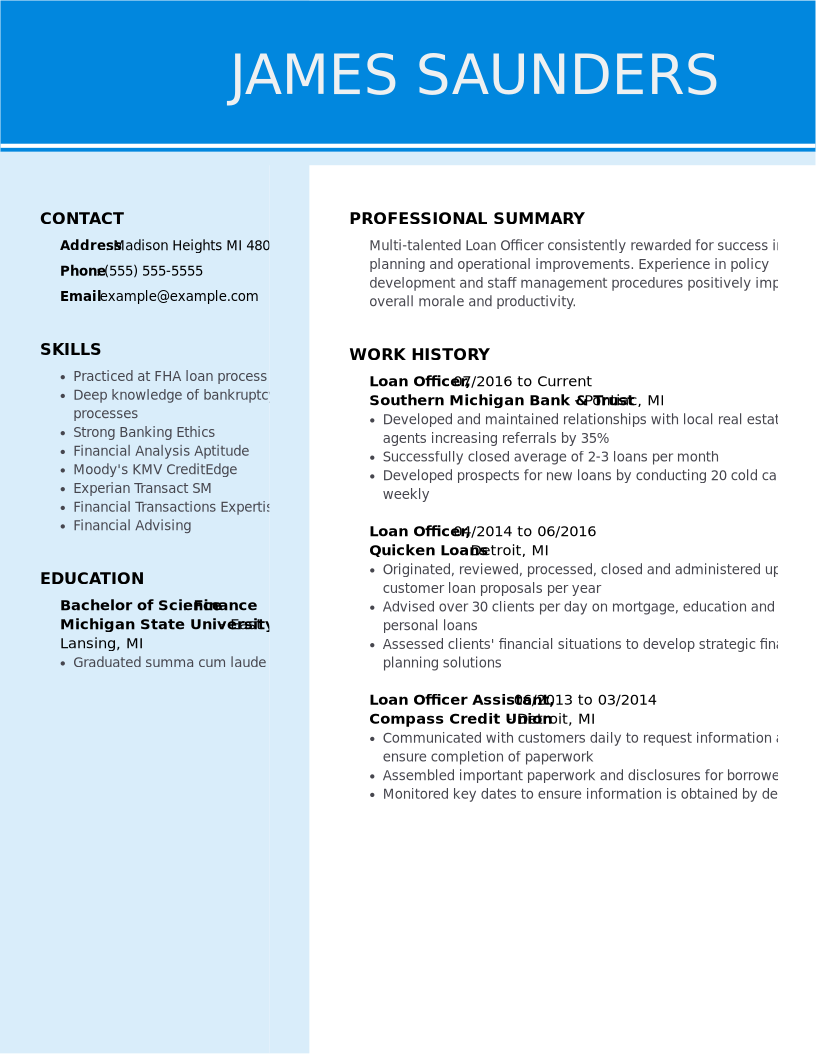

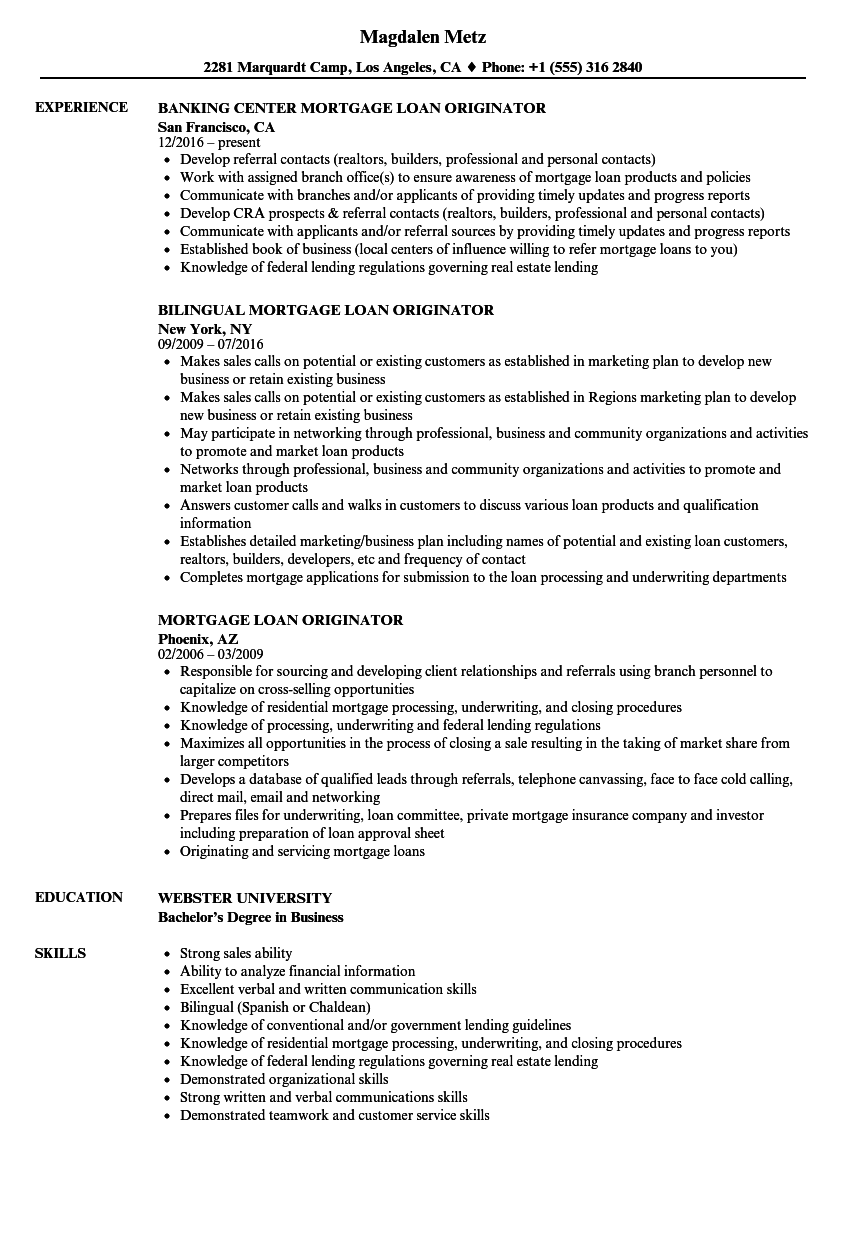

Mortgage Loan Officer Resume Examples Banking Livecareer

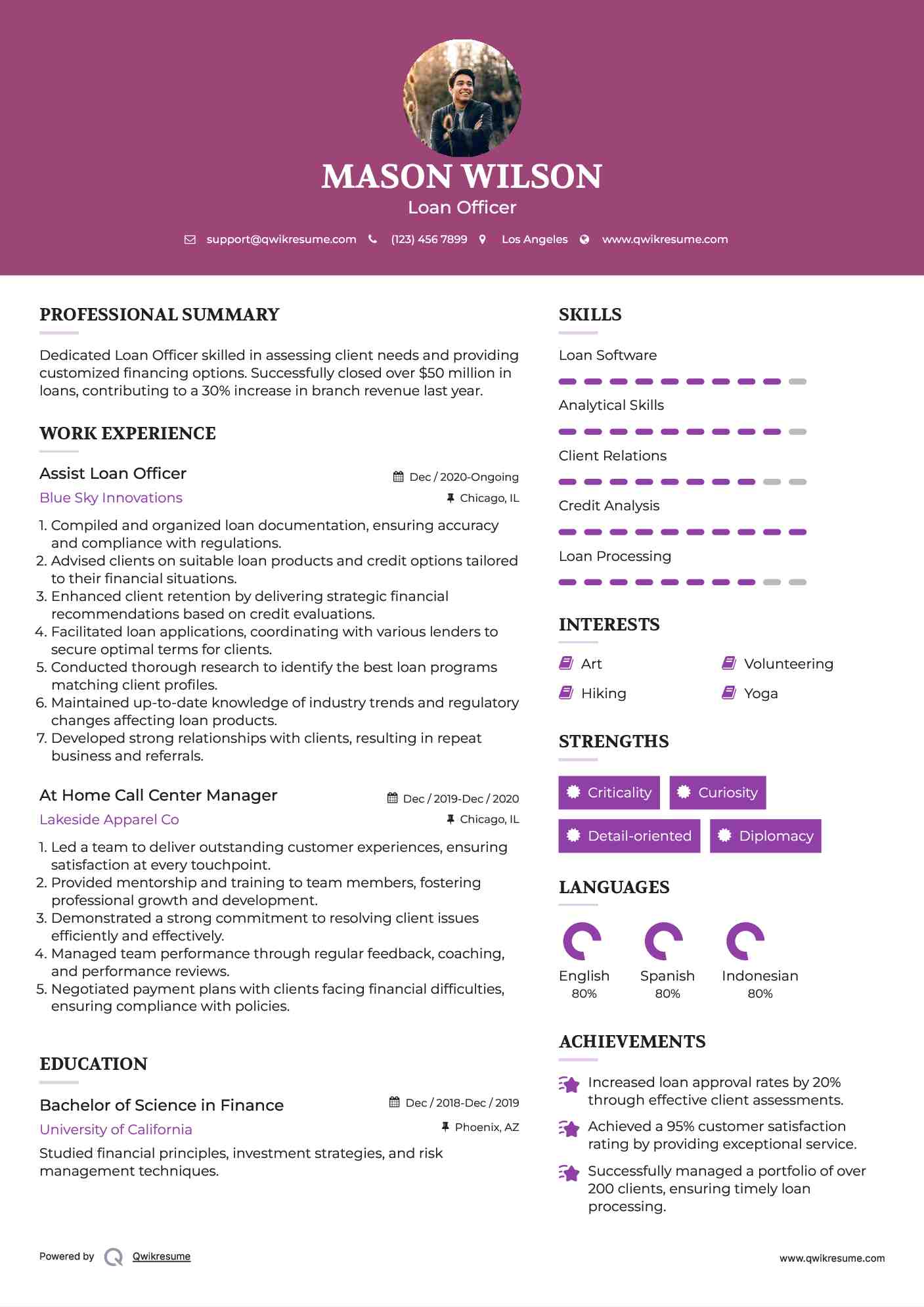

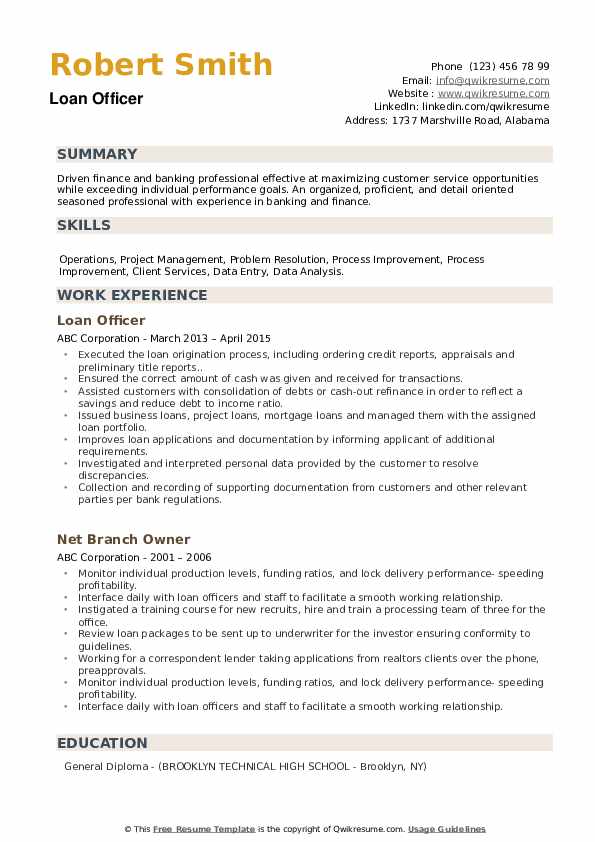

Loan Officer Resume Samples Qwikresume

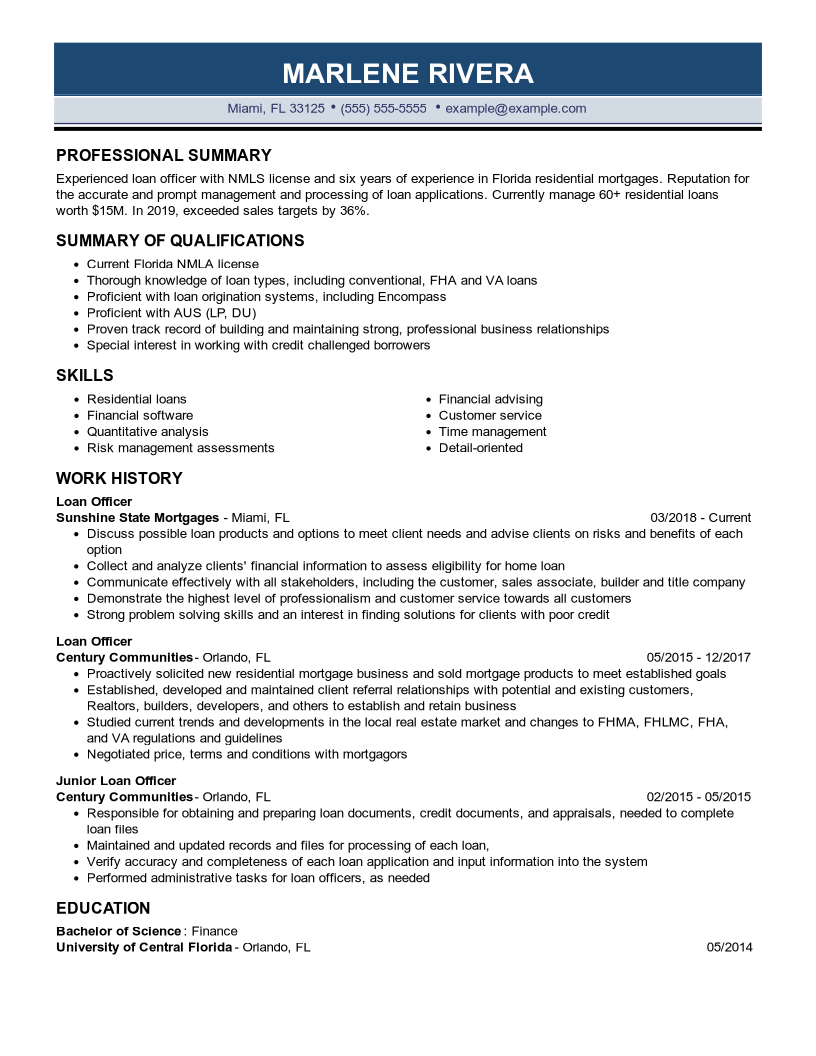

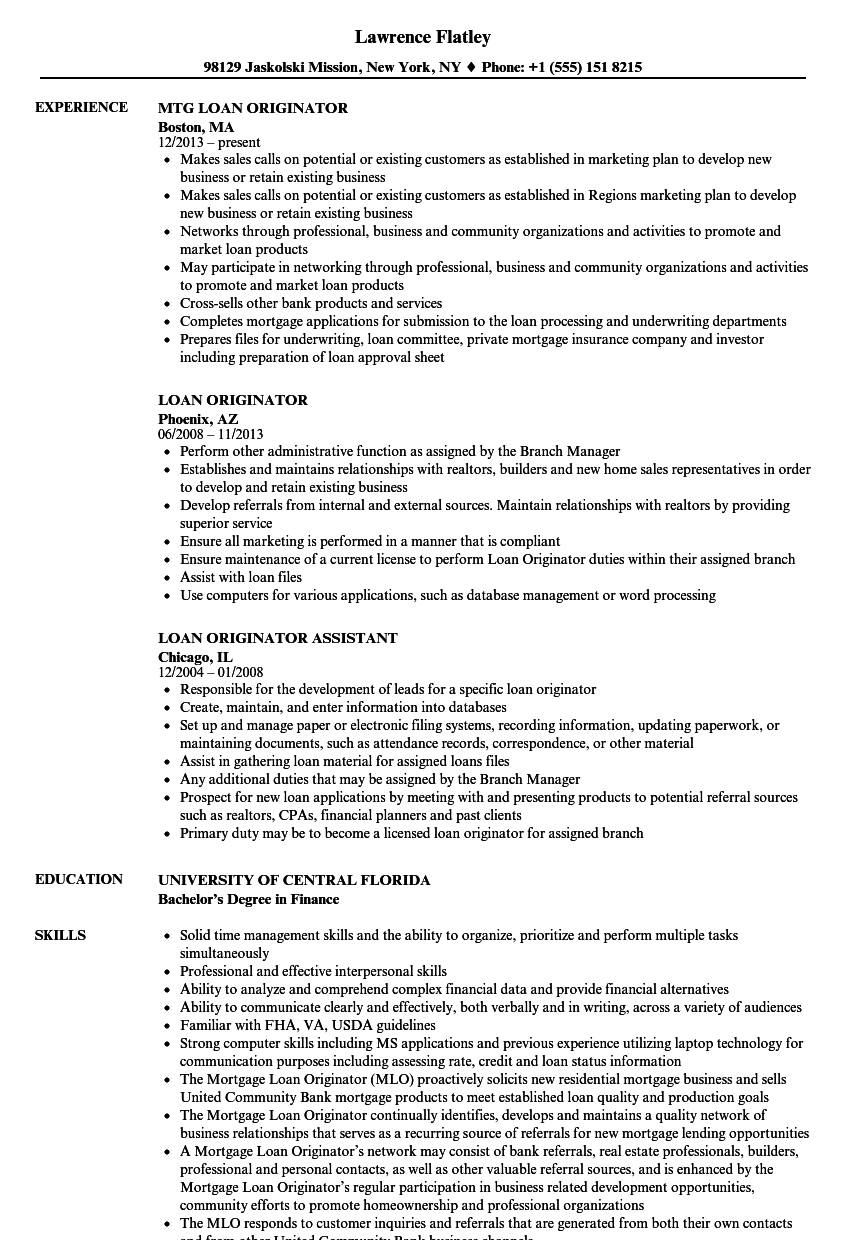

Loan Officer Resume Examples Banking Livecareer

Mortgage Loan Originator Resume Samples Velvet Jobs

Loan Officer Resume Samples Qwikresume

Lendus Llc Mortgage Loan Officer Resume Sample Resumehelp

Mortgage Loan Originator Resume Sample Mintresume

Loan Officer Resume Sample With Job Description Skills

Loan Officer Resume Samples Qwikresume

Loan Originator Resume Samples Velvet Jobs

![]()

Loan Officer Resume Sample With Job Description Skills

Loan Officer Resume Example Writing Tips For 2022

Loan Officer Resume Sample With Job Description Skills

Mortgage Loan Officer Resume Example Myperfectresume

Loan Officer Resume Samples Qwikresume